Andre and Elena are each saving money, but their journeys are vastly different. Andre is a young professional with a high salary, while Elena is a stay-at-home mom with a limited income. Despite their different circumstances, both Andre and Elena are determined to reach their financial goals.

This article will explore their individual savings strategies, challenges, and habits, providing insights into the complexities of personal finance and the pursuit of financial freedom.

Andre and Elena’s stories offer valuable lessons for anyone looking to improve their financial well-being. Whether you’re just starting to save or you’re looking to take your savings to the next level, their experiences can help you overcome obstacles, make informed decisions, and achieve your financial goals.

Andre and Elena’s Savings Journey: Andre And Elena Are Each Saving Money

Andre and Elena are two individuals with distinct financial aspirations and saving strategies. Their journeys provide valuable insights into the complexities of personal finance and the challenges of achieving financial goals.

Individual Savings Goals

Andre, a young professional, is driven by the desire to purchase a home within the next five years. He aims to save a substantial down payment to secure a mortgage with favorable terms.

Elena, on the other hand, is a stay-at-home mother who is focused on providing a secure financial future for her family. Her savings goal is to build an emergency fund and invest for her children’s education.

Savings Strategies, Andre and elena are each saving money

Andre’s saving approach is systematic and disciplined. He allocates a fixed percentage of his monthly income to a high-yield savings account. Additionally, he contributes to his employer-sponsored 401(k) plan.

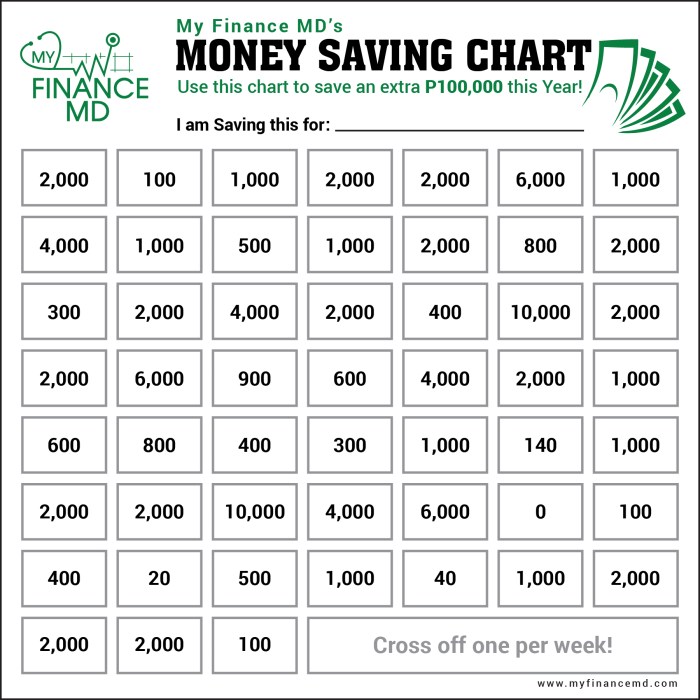

Elena employs a more flexible saving strategy. She sets aside a portion of her husband’s income each month, adjusts her spending habits to reduce expenses, and participates in community savings programs.

While their techniques differ, both Andre and Elena are committed to prioritizing saving and minimizing unnecessary expenditures.

Challenges and Obstacles

Andre faces challenges in maintaining his savings plan due to unexpected expenses and lifestyle inflation. He also struggles with temptation to make impulsive purchases.

Elena encounters obstacles such as rising childcare costs and fluctuations in her husband’s income. She also faces the temptation to use savings for immediate needs rather than long-term goals.

Overcoming these challenges requires a strong mindset, financial discipline, and a willingness to adjust strategies as needed.

Financial Discipline and Habits

Andre’s financial discipline is evident in his budgeting practices. He tracks his expenses meticulously and avoids unnecessary spending. He also reviews his financial goals regularly to ensure he is on track.

Elena demonstrates financial discipline by limiting her discretionary spending and making wise purchasing decisions. She creates a monthly budget and adheres to it as closely as possible.

Their disciplined habits have enabled them to make significant progress towards their savings goals.

Savings Timeline and Projections

Andre projects to have saved approximately $100,000 within the next five years, sufficient for a substantial down payment on a home.

Elena estimates her emergency fund will reach $15,000 within the next two years, providing a safety net for unexpected expenses.

Factors that may influence their savings timelines include economic conditions, changes in income, and unexpected financial setbacks.

Long-Term Financial Goals

Andre’s long-term financial goal is to retire early and travel the world. His savings will provide the financial security and flexibility to pursue his passions.

Elena’s long-term financial objective is to ensure her family’s financial well-being. Her savings will contribute to her children’s education, a secure retirement, and a comfortable lifestyle.

Their savings journeys are a testament to the importance of setting clear financial goals, developing effective saving strategies, and maintaining financial discipline over time.

FAQ Summary

How much money should I save each month?

The amount of money you should save each month depends on your individual circumstances and financial goals. However, a good rule of thumb is to save at least 10% of your income.

What is the best way to save money?

There are many different ways to save money. Some popular methods include creating a budget, tracking your expenses, and cutting back on unnecessary spending.

What are some common challenges to saving money?

Some common challenges to saving money include unexpected expenses, lack of financial discipline, and unrealistic financial goals.